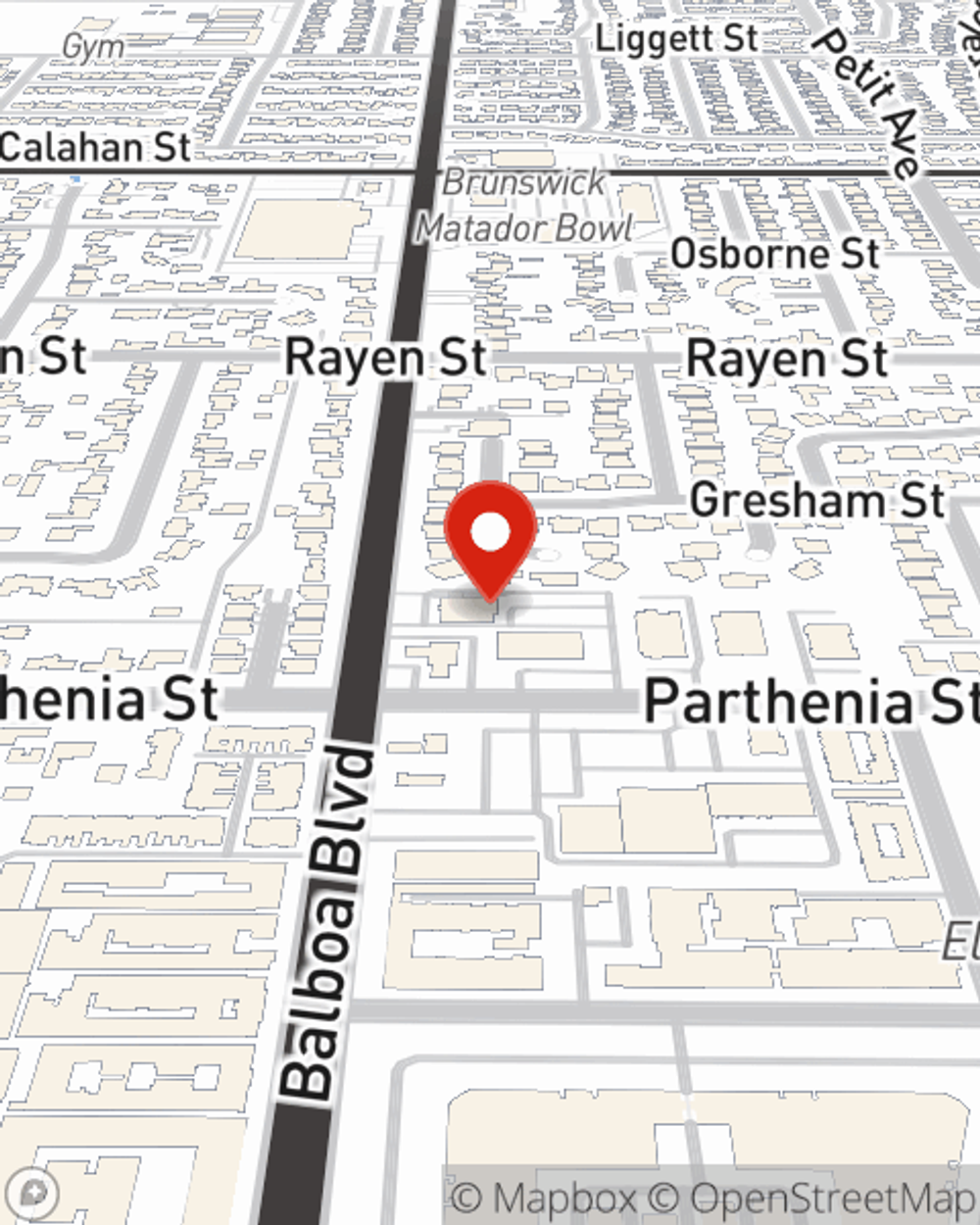

Business Insurance in and around Northridge

Looking for small business insurance coverage?

Insure your business, intentionally

Help Protect Your Business With State Farm.

Sometimes the unanticipated does occur. It's always better to be prepared for the unfortunate catastrophe, like a customer stumbling and falling on your business's property.

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Jimmy Bacani is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such attentive service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Jimmy Bacani can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by contacting State Farm agent Jimmy Bacani today to research your business insurance options!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Jimmy Bacani

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.